I recently watched a webinar specifically created for women to take care of, and grow, their finances. At the core of everything they pitched was a simple concept (and one that I’ve written about for nearly a decade): aligning your money with what it is that you want.

Such a basic notion! Who could disagree? Everyone wants to align their spending, saving, and money decisions with what is important to them.

But, so much less simple is the outworking of this obvious, near-universal truth.

Why is it such a challenge to align our money with our values, goals, wishes, & dreams?

I think that there are a few things at play...

Marketing Tactics Have a Powerful Sway on our Spending

It’s not you, it’s them! There are very powerful psychological tools at work to convince us to “Buy now” without thinking too much about it. From end-caps and checkout racks at in-person stores, to cart add-ons, countdown timers, coupon spin-a-wheels, & one-click checkout in online boutiques, it is very easy to shop.

Sophisticated thought and intentional work goes into these choices so that shoppers will bypass thought and intention, and act out of emotion, fear, or false-urgency.

Guilt & Shame over Money Leads to Avoidance

This is true for so many aspects of money: guilt for not investing sooner, shame over debt or bad decisions, embarrassment over making dumb purchases or overspending.

Not wanting to feel those uncomfortable emotions, we just avoid the conversation, confronting the realities only when its necessary, like paying the credit card bill.

Wishful Living and Lifestyle Creep

I don't know about you, but adults tend to have a lot on their plates! So many responsibilities, mental tabs open, worries about the world, etc. that often, we just want to buy an overpriced coffee, or grocery shop with abandon, and not think about the ramifications of one. more. thing.

Sometimes we can absorb & spend money without really deciding how we actually want to spend it, just out of ease, simplicity, or wanting to live out a certain lifestyle. It feels freeing in the moment, but doesn't necessarily equate to our bigger-life goals and values.

So... what to do to have cohesion and confidence with money choices?

Be Considerate with Whom You Give Your Money To, and What You Get in Return

Very simply, just remembering to ask yourself... Do I really want this thing? Is this how I want to spend my money? Do I like and support this business? Will I be glad that I made this purchase? Would I rather spend/donate/save this other way? Is this good value for what it costs? etc.

And when it is what you want: feel great about it! I found a leather bag that I thought was gorgeous, had great reviews, from a maker with a good reputation. I went for it and am so thrilled with the purchase.

Be Honest, And Kind, With Yourself About Money

Being intentional about aligning money decisions with our values means we have to be honest with our avoidance, procrastination, and missteps. Time to get your big girl (or boy) pants on, and take it on!

If you lacked education about money management, seek it out. If you feel on your own, ask for help. Remember what I said above about how sophisticated the systems are that are working against your intentional spending — be gentle and forgiving with yourself!

But, be real, too. What do I want for myself? What do I want for the world? Take some time in an enjoyable setting to consider, and then define, what your goals, priorities, and values are.

For our family, we're really feeling how few years we have left with our kids as kids in our house! We value spending quality time with them, and creating memories together, so are making decisions and expenses to prioritize that in the coming years.

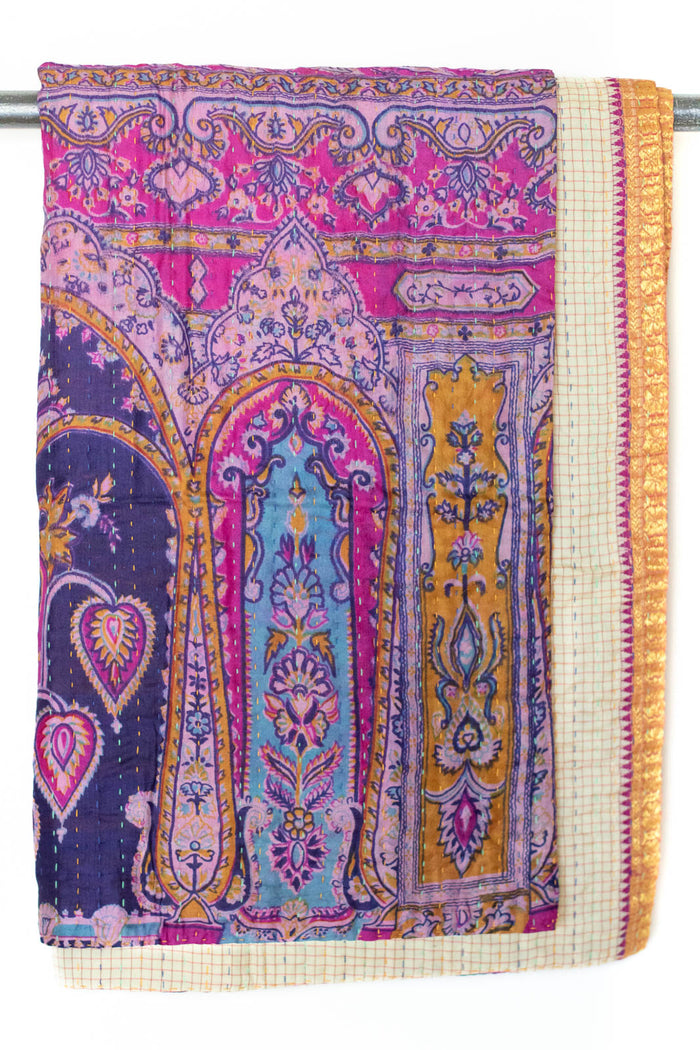

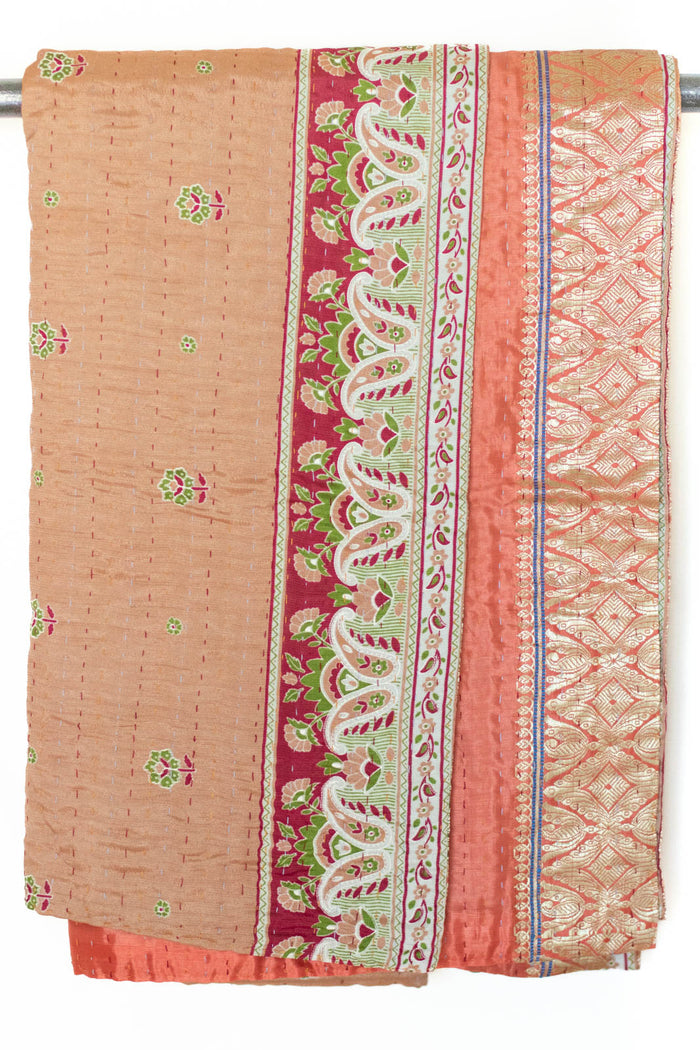

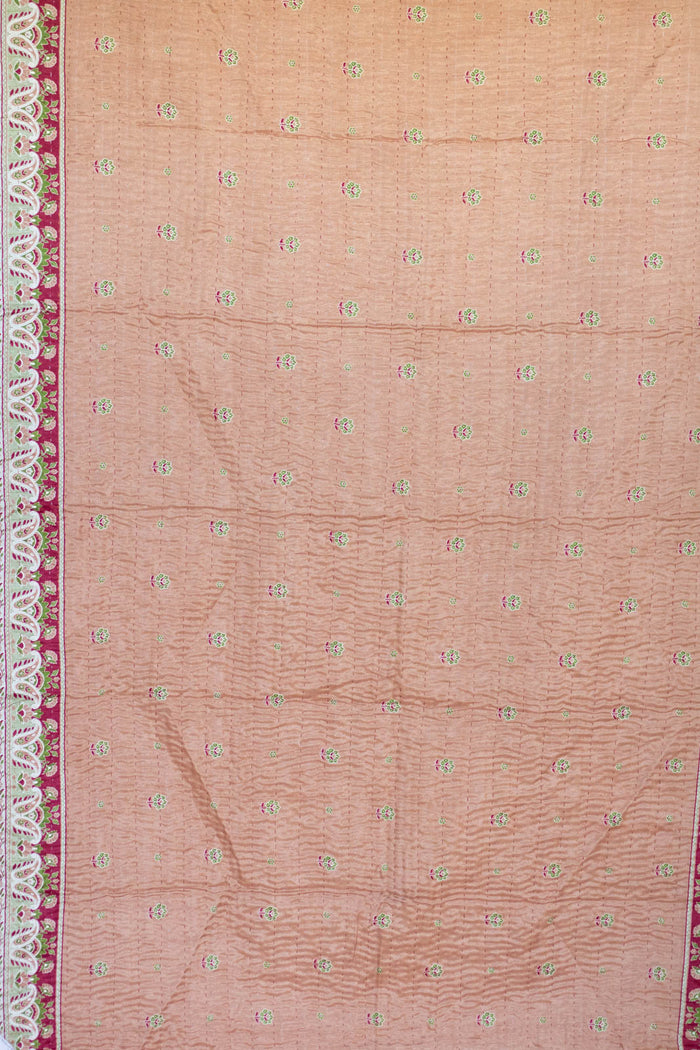

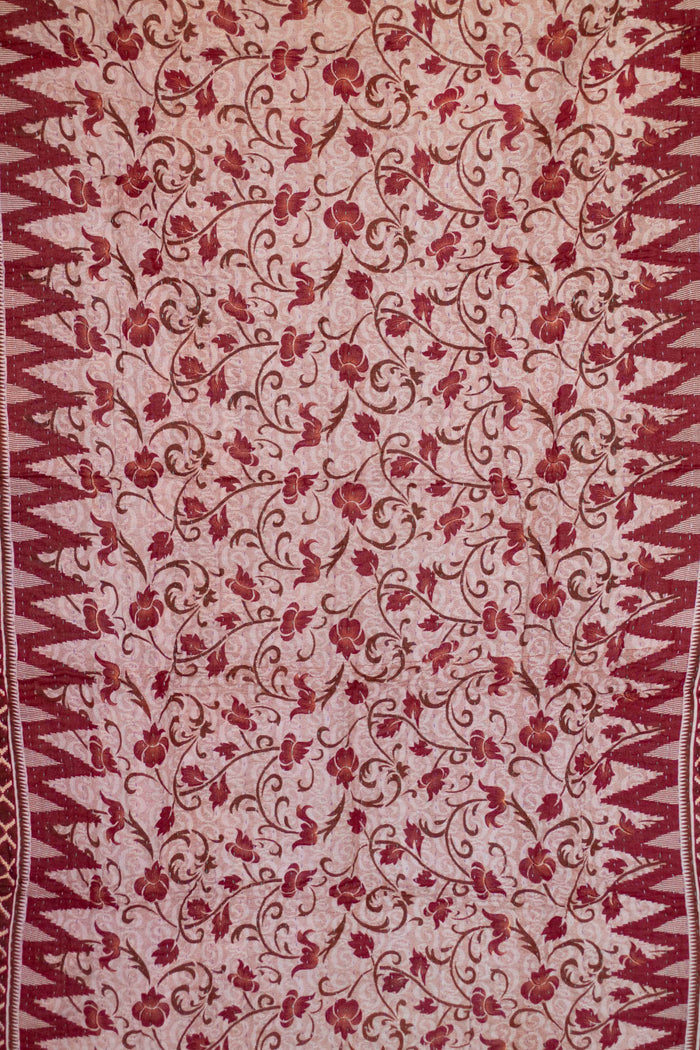

For me, I want to pay attention to my own personal style this year and have decided that this is a priority for me, financially. I have some closet failures and duds that I just have to let go of & accept were poor choices! But, as I choose pieces, follow good advice (Allison Bornstein!), and make purchases, I can feel great about this personal investment.

Make the Decisions with a Clear Mind, and Let Intentional You Help Future You

Some financial advisors would encourage that if you can get the big stuff managed, you can free yourself from worrying about the little stuff. I don't think you ever want to spend indiscriminately, but it is a good goal to get to a place where your money choices elicit confidence, not guilt.

A great piece of advice is to automate and systematize decisions to align with your goals & values; then, you don't have to constantly evaluate whether you're on the track you want.

For example:

- create auto-withdrawals for savings, retirement, college, etc. — anything that you are prioritizing, make the decision ahead of time, and move the money out of your main account so that it doesn't even factor in.

- preset the amount of money you have for coffee in a month on a Starbucks card (or the like). When it's gone, no more coffee! (disable auto-reload 😏)

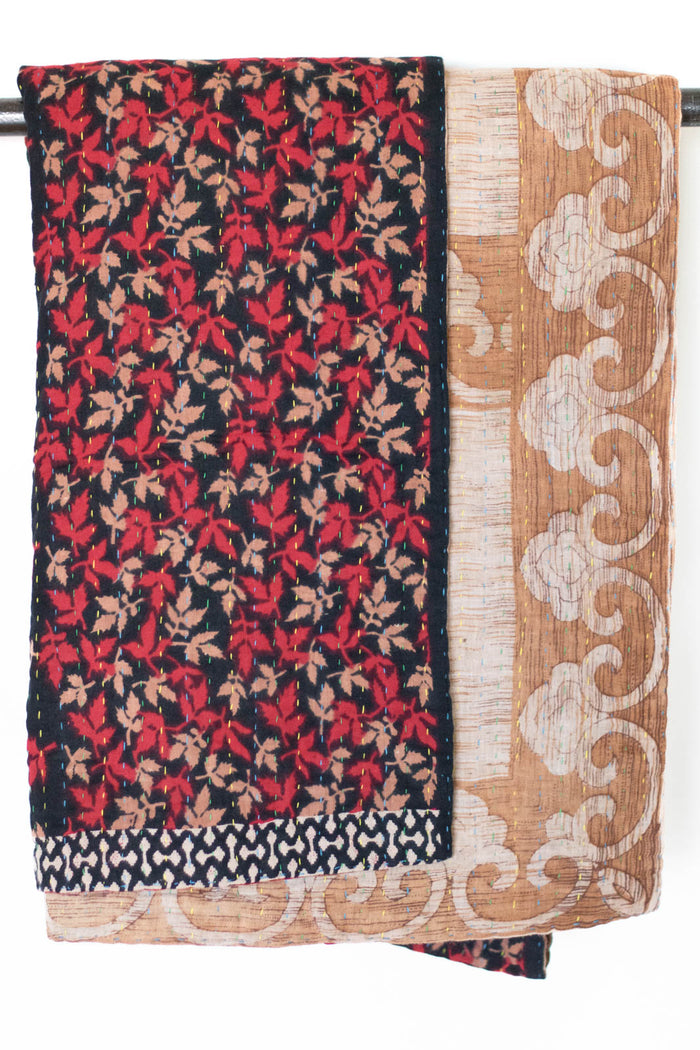

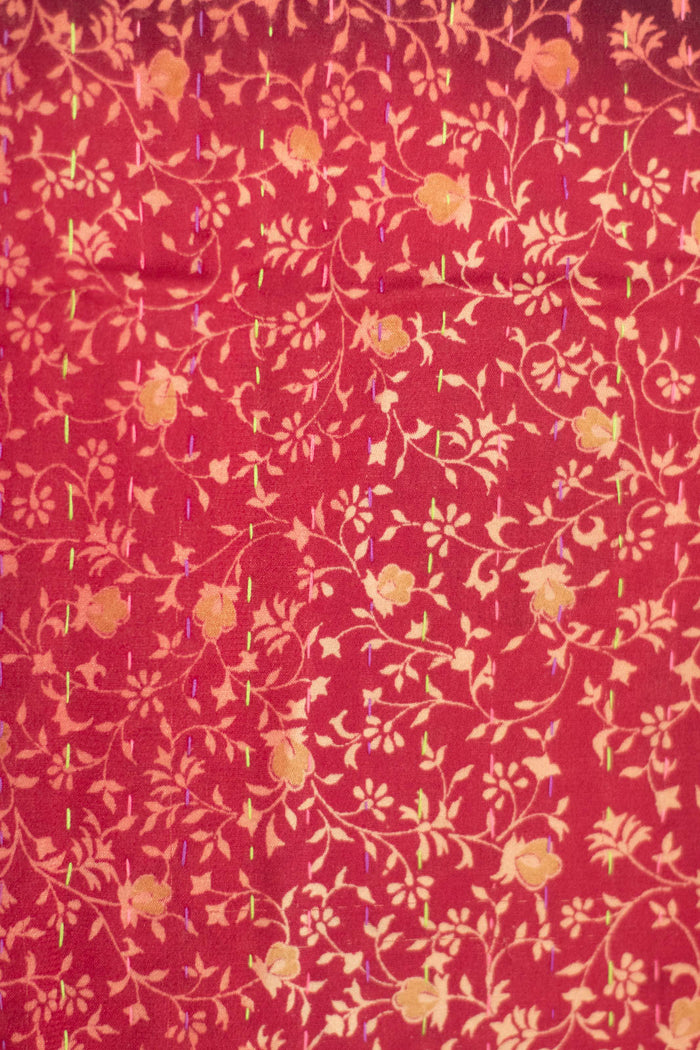

- in my example above of my personal style makeover, I've set a clothing budget, now I can spend it all! Setting positive "budgets" for things (in clear-minded times) can give us the confidence to be happy when we do spend the money. (Or, buy a blanket! 😉)

This stuff may take some work to get going... but after the initial speed bump & heavy lift, then confidence, satisfaction, and alignment await!

Has money been a journey for you? Are you stuck or overwhelmed, or have you experienced wins in this area? Share any thoughts in the comments below.